35+ 15 year balloon mortgage calculator

The most common mortgage terms are 15 years and 30 years. 12859046 12795071 63975.

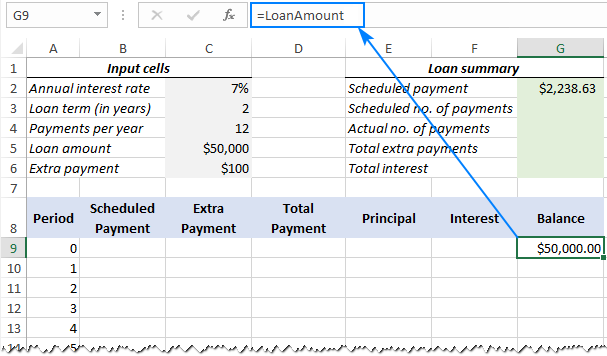

Tables To Calculate Loan Amortization Schedule Free Business Templates

A balloon mortgage can be an excellent option for many home buyers.

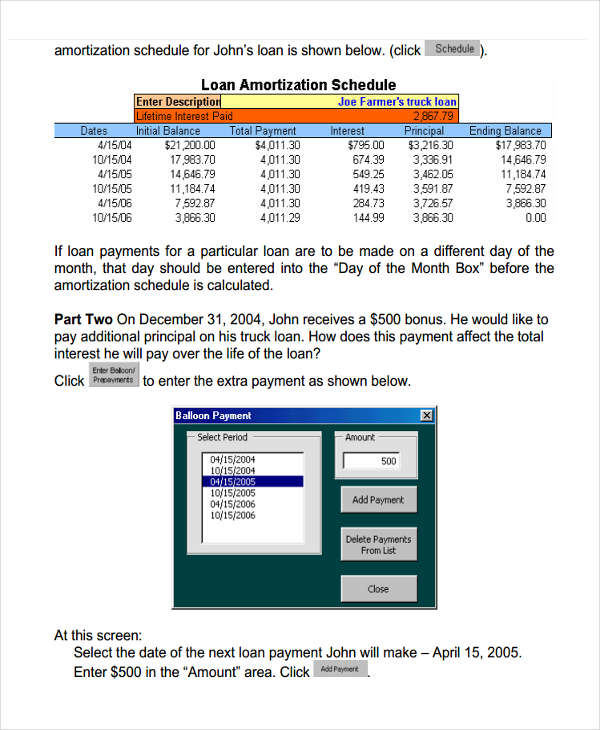

. A balloon mortgage is usually rather short with a term of 5 years to 7 years but the payment is based on a term of 30 years. Most balloon loans are typically for a 5 or 10 year repayment period with a 30 year amortization term. If you enter the year count we will automatically calculate the final payment.

You are getting a 150000 mortgage loan with a 3 year fixed interest rate of 45. As we mentioned the balloon payment is the final payment which pays off the remaining balance after the last period of the monthly payment. A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years.

90000 Loan Amount. A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years. Ad Our Calculators And Resources Can Help You Make The Right Decision.

For example if a balloon loans payment is based on a 30-year payback period and the balance is due after 3 years that would be considered a 330 balloon loan. The loan amount the interest rate and the term of the mortgage can have a dramatic effect on the total amount you. They often have a lower interest rate and can be easier to qualify for than a traditional 30 year fixed mortgage.

The number of years over which you will repay this loan. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance.

If you enter the final payment then you can see the loan term in the printable. A balloon mortgage is usually rather short with a term of 5 years to 7 years but the payment is based on a term of 30 years. Estimate The Home Price You Can Afford Using Income And Other Information.

They often have a lower interest rate and can be easier to qualify for than a traditional 30 year fixed mortgage. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options. They often have a lower interest rate and can be easier to qualify for than a traditional 30 year fixed mortgage.

Borrowers would have to put 50 down take out a three or five-year loan then face a balloon payment at the. After that the rate can change. 425 Interest Rate.

35 Year Mortgage Calculator Lake Water Real Estate Floify just unleashed its completely redesigned landing pages which. They often have a lower interest rate and it can be easier to. A 15-year mortgage will save you money in the long run because.

A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years. A balloon mortgage can be an excellent option for many home buyers. A balloon mortgage can be an excellent option for many home buyers.

84 Previous Number of Monthly Payments 1 each month until Balance 0. Monthly Payment 12. A balloon mortgage can be an excellent option for many home buyers.

There are pros and cons to both 15- and 30-year mortgages. Ad Top Home Loans. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

This would mean that the payment amount would be calculated as if the loan were going to be paid back over a 30-year period -- which essentially lowers the payment for the pre. 7 Yrs Previous Number of Monthly Payments 1 each month until Balance 0 12 to convert to years and months Loan Balance after Length of Balloon Period Interest. A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. There is however a risk to consider. A balloon mortgage is a type of loan repayment option with a short term and a large lump sum payment due at the end of the loan.

There is however a risk to consider. A balloon mortgage can be an excellent option for many home buyers. How Much Interest Can You Save By Increasing Your Mortgage Payment.

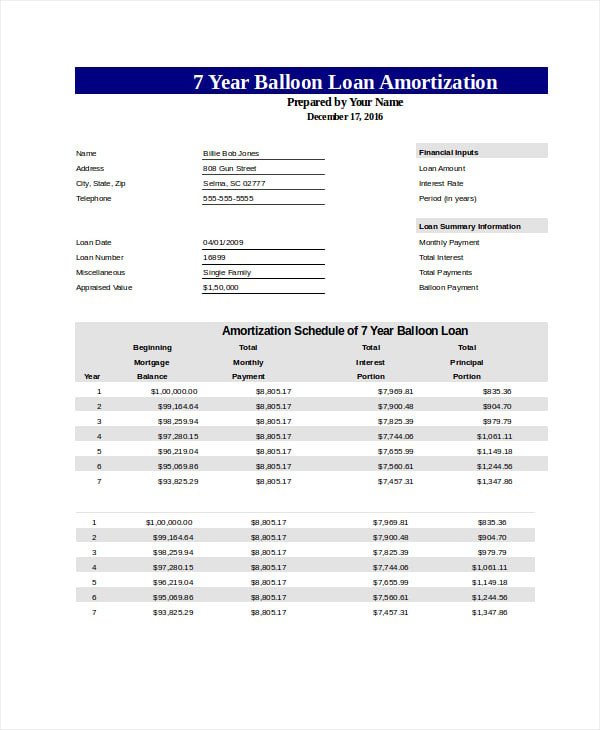

Balloon Loan Amortization Schedule. A balloon mortgage can be an excellent option for many home buyers. Press the Balloon Only button and you will see that you can pay off the mortgage with a balloon payment of 6632813.

Lets say you took a 30-year fixed USDA loan worth 250000 at 3 APR. 67705 Monthly Payment. There is however a risk to consider.

Since the monthly fixed payment is computed with a more extended usually 20-30 year. It is the 30 years which you would enter below. There is however a risk to consider.

They often have a lower interest rate and can be easier to qualify for than a traditional 30 year fixed mortgage.

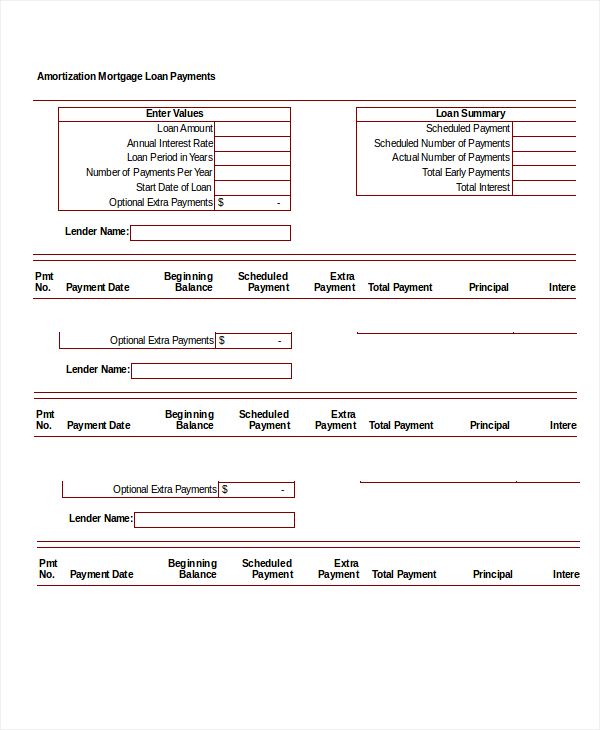

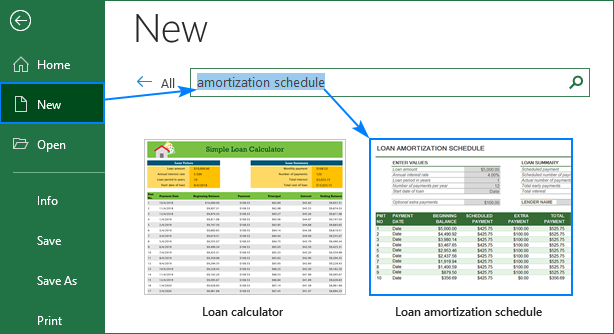

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Payment Schedule Template Awesome 5 Loan Amortization Schedule Calculators Amortization Schedule Schedule Template Cleaning Schedule Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Ppmt Function With Formula Examples

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

115 Real Estate Infographics Use To Ignite Your Content Marketing Updated Real Estate Infographic Real Estate Agent Marketing Real Estate Education

29 Amortization Schedule Templates Free Premium Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End